Richer Rental

12 Tips and Tricks to help Cut Costs and Streamline your Airbnb in 2024

Airbnb not as profitable as you would like???

Check out these 12 Tips and Tricks to help Cut Costs and Streamline your Airbnb!

Table of Contents (clickable)

- Increase Your Airbnb Profits

- List of products in the above video:

- Home Made Cleaning Solution

Increase Your Airbnb Profits: Grassroots Strategies for Lowering Your Airbnb Bottom Line

Running a successful Airbnb or rental business hinges on maintaining a healthy balance between revenue and expenses. In challenging times, such as low occupancy rates or unexpected downturns, cutting costs becomes essential to staying in the game! Below I explore some practical grassroots tactics to help you trim expenses and boost your bottom line without compromising on quality or guest satisfaction.

- Optimize Operational Efficiency:

- Consider giving you cleaner ‘a break’ and taking on a few cleanings yourself, or take some time to research more cost-effective cleaning services.

- Implement energy-saving measures to reduce utility bills, such as installing programmable thermostats or switching to LED lighting.

- Consider turning down your heat or AC in between guest stays, especially if the gaps are more than a couple days (consider getting the Ecobee to be able to do this remotely from your phone).

- Negotiate lower rates with utility providers or explore alternative energy sources like solar power or heat pumps.

- Strategic Purchasing:

- Purchase cleaning supplies and essentials in bulk from wholesale retailers like Costco, Sam’s Club, or Walmart to take advantage of bulk discounts.

- Invest in high-quality, durable furniture and amenities that offer longevity and require minimal maintenance.

- Consider buying used from Facebook Market Place or Craigslist. This is where you will get the best bang for your buck.

- Similarly, explore second-hand or refurbished furniture options to furnish your property at a fraction of the cost of new items.

- DIY Maintenance and Upkeep:

- Save on landscaping expenses by maintaining your yard yourself or investing in low-maintenance landscaping solutions.

- Learn basic DIY repair skills to handle minor maintenance tasks like plumbing repairs, painting, or minor electrical work.

- Regularly inspect your property for issues to address them promptly, preventing costly repairs down the line… “a stich in time saves nine”.

- Streamline Guest Services:

- Utilize automated check-in and check-out processes to minimize the need for management costs, or taking up more of your time (allowing you to focus more on growing your business).

- Provide digital guides or instructional videos to guests to reduce the need for personal assistance and streamline the guest experience. Check out Hostfully – you get one FREE guest book account (I have got a lot of compliments on mine over the years).

Hopefully you found these tips helpful and can see how easy it is to save hundreds, if not thousands of dollars annually by implementing these grassroots strategies, and without having to compromise on service quality or guest experience. Embracing cost-saving measures and optimizing operational efficiency will not only improve your profitability but also enhance the resilience of your business during challenging times, be it local downtowns or recessions. Remember, every dollar saved contributes to the long-term success and sustainability of your Airbnb venture.

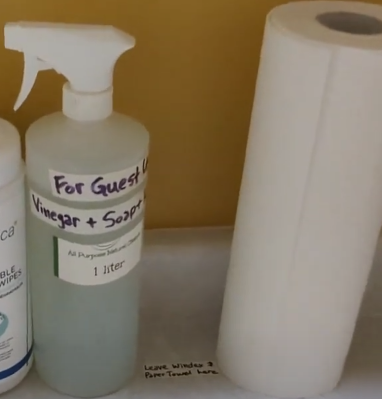

Home Made Cleaning Solution

Per 1 Liter bottle use:

-

- 1/4 White Vingar

- 3/4 Water

- 2-3 squirts dish soap (I like Sunlight)

Best Wireless Security Cameras Without Subscription in 2024

Protect Your Airbnb / Personal Property: Home Security Camera Setup & Review + Full List of Benefits

Best Wireless Security Camera Without Subscription

I’m going to save you a lot of time, energy, research, and disappointment by telling you that the Lorex 4K is the best product on the market for the price and to look no further.

Yes, there are cheaper models (e.g. light bulb cameras), but trust me, you get what you pay for. There are also some decent competitors out there too, such as the Google Nest Security Cam, but they come with monthly subscription fees, so in the long run you will end up paying more (I’ve done the math)! The storage on the Lorex 4K is solid, storing up to weeks of footage – no subscriptions! The app is seamless and easy to use. The camera is very easy to install (see video above). And for the techies, it’s compatible with with Alexa and Google Home.

Scroll to the bottom of the page to see the full list of benefits of this model and how it can improve safety, security, and peace of mind for your home or property.

For the DIYers, here is a simple list of supplies you may need for the install.

Personally, I can almost always justify buying new tools for a job if the tool cost is about what I would pay for someone else to do the job for me (even if I think I might never need the tool again, but that’s just me).

#1 Screw driver or drill with some bits. Drill is easiest, and is essential if you want to secure to aluminum soffits with self tapping screws as I did.

#2 The Lorex 4K comes with screws and fasteners!!! But it didn’t have self tapping screws. These are required for securing to metal surfaces like I did in the video.

and hex bits/heads, for the self-tapping screws

#3 Ok, so pretty much my favorite around-the-house product of all time – Shoe Goo! This stuff is amazing for quick fixes. It is slightly flexible, highly durable, clear, and waterproof, and binds to all materials exceptionally well! Epoxy is good, but it isn’t great for binding plastic to plastic like I demonstrated with the deflector I installed on the backyard security camera. Anyways each tubes pays for itself many times over with all the repairs it can accomplish – love this stuff.

Still not convinced on the game changing benefits of a wireless home security camera? Ok, here is the legit, comprehensive list:

-

Remote Access: You can monitor your property in real-time from anywhere with an internet connection, giving you peace of mind when you’re away from home or the office.

-

24/7 Surveillance: The Lorex 4K offers continuous recording or motion-activated recording, ensuring you have a record of all activities around your property at all times.

-

Deterrence: Visible security cameras act as a deterrent to potential intruders and vandals, reducing the risk of criminal activity. The Lorex 4K has a setting where a bright LED turns on when motion is detected.

-

Evidence Collection: In case of incidents or criminal activities, having recorded footage can provide crucial evidence to law enforcement or for insurance claims. Hey, this time you will actually get your money back for stolen Amazon packages! 😅

-

Notifications and Alerts: Security camera apps often offer customizable alerts and notifications for motion detection, allowing you to be instantly aware of any vehicles, people, or animals.

-

Two-Way Communication: The Lorex 4k has built-in microphones and speakers, enabling you to communicate with people on your property remotely, such as delivery drivers or visitors.

-

Integration with Other Smart Devices: The Lorex 4K can be integrated with other smart home devices like Alexa or Google Home.

-

Energy Savings: By being able to check your property remotely, you can find out if lights have been left on, or things of that nature (e.g. sprinklers).

-

Peace of Mind: Whether you’re checking in on your children, elderly family members, that your cleaner has showed up, or pets, having access to your security cameras on your phone provides peace of mind and helps ensure safety.

-

Insurance Savings: You may be eligible for discounts on your home insurance. Let your broker know the next time your renew!

-

Fire Prevention: Can ensure that camp fires have been put out fully and properly!

-

Record and Share Footage: You can save and share video clips or images of notable events, whether it’s for documentation or sharing funny, memorable moments, or beautiful wildlife!

-

Cost-Effective: Compared to traditional security systems with dedicated monitors, using your phone as the viewing device can be more cost-effective and convenient. No more monthly bills to big name security companies!

-

User-Friendly Interface: The Lorex is designed with user-friendliness in mind, making it easy for both tech-savvy and non-tech-savvy individuals to use.

-

Mobile Alerts: You can easily set it up to receive instant alerts on your phone for any unusual activities, which can help you respond quickly in case of emergencies.

-

Historical Footage: You can review past footage to check for any incidents or activities that occurred when you were not actively monitoring the camera.

-

Did it snow??? Check the cameras to see if your driveway needs to be plowed before you or your guests arrive!

I’ll close with a disclaimer regarding rental properties or short-term rentals such as Airbnb or VRBO. There’s a balance between keeping your place safe and secure, and your guest’s privacy. However, and this should be pretty obvious, do not install security cameras inside a rental dwelling/residence, nor outside in such a manner where there is a view into/towards the dwelling. Moreover, never intentionally conceal recording devices of any kind. To learn more on Airbnb’s recommendations, click here , and for VRBO’s click here.

Attention Airbnb or VRBO Owners! Liking what you are seeing?!

Head to this page to get my FREE Septic Bathroom Sign. This printable and frameable sign could save you thousands in septic bills.

Want to get started on Airbnb? Use this link and earn an extra $54 on your first booking:

Should You Build a Vacation Rental Website

The short answer… YES! (for the vast majority of cases)

As a savvy Airbnb host, you know that having a great online presence is key to success. But did you know that having your own website can give you a serious advantage over your competitors? Here are just a few of the many benefits of having your own website for your Airbnb:

- You control the narrative: When potential guests search for your listing on Airbnb, they’re seeing your property through the lens of Airbnb’s platform. But with your own website, you have the ability to present your property exactly how you want it to be seen. You can showcase more photos, highlight specific amenities or features, and give potential guests a more personal look at what makes your property unique.

- It can improve your search rankings: When people search for accommodations online, they’re often using Google or another search engine. By having your own website, you have the opportunity to optimize your content for search engines, which can help your website show up higher in search results. This means more visibility for your property and potentially more bookings.

- You can build your brand: Your Airbnb property is just one aspect of your business. By having your own website, you can start to build a brand around your property and your hosting style. This can help you stand out from the competition and give potential guests a reason to choose your property over others.

- It’s a professional touch: Let’s face it, having your own website just looks more professional. It shows potential guests that you take your hosting seriously and that you’re willing to invest in your business. Plus, having your own website can help establish trust with potential guests who might be hesitant to book with a stranger on Airbnb.

- You can collect guest information: When guests book through Airbnb, you’re limited in terms of the information you’re able to collect. But with your own website, you can collect email addresses, phone numbers, and other information that can help you market to past guests and build a loyal following.

Overall, having your own website is a smart move for any Airbnb host who wants to take their business to the next level. Whether you’re just starting out or you’re a seasoned host, investing in a website can help you stand out from the crowd, improve your search rankings, and build a brand that guests will remember. So why wait? Start building your website today and watch your bookings soar!

As a savvy Airbnb host, you know that having a great online presence is key to success. But did you know that having your own website can give you a serious advantage over your competitors? Here are just a few of the many benefits of having your own website for your Airbnb:

- You control the narrative: When potential guests search for your listing on Airbnb, they’re seeing your property through the lens of Airbnb’s platform. But with your own website, you have the ability to present your property exactly how you want it to be seen. You can showcase more photos, highlight specific amenities or features, and give potential guests a more personal look at what makes your property unique.

- It can improve your search rankings: When people search for accommodations online, they’re often using Google or another search engine. By having your own website, you have the opportunity to optimize your content for search engines, which can help your website show up higher in search results. This means more visibility for your property and potentially more bookings.

- You can build your brand: Your Airbnb property is just one aspect of your business. By having your own website, you can start to build a brand around your property and your hosting style. This can help you stand out from the competition and give potential guests a reason to choose your property over others.

- It’s a professional touch: Let’s face it, having your own website just looks more professional. It shows potential guests that you take your hosting seriously and that you’re willing to invest in your business. Plus, having your own website can help establish trust with potential guests who might be hesitant to book with a stranger on Airbnb.

- You can collect guest information: When guests book through Airbnb, you’re limited in terms of the information you’re able to collect. But with your own website, you can collect email addresses, phone numbers, and other information that can help you market to past guests and build a loyal following.

Overall, having your own website is a smart move for any Airbnb host who wants to take their business to the next level. Whether you’re just starting out or you’re a seasoned host, investing in a website can help you stand out from the crowd, improve your search rankings, and build a brand that guests will remember. So why wait? Start building your website today and watch your bookings soar!

How to Avoid Capital Gains Tax on Rental Property Canada

I present to you… THE SMITH MANEUVER

If you’re a Canadian homeowner, you may have heard of the Smith Maneuver. It’s a strategy that’s been gaining popularity in recent years as a way to make your mortgage tax-deductible and build wealth over the long term. In this post, we’ll explain how the Smith Maneuver works and why you might want to consider it.

What is the Smith Maneuver?

The Smith Maneuver is a financial strategy that allows Canadian homeowners to convert non-deductible mortgage interest into tax-deductible investment interest. The strategy is named after Fraser Smith, the financial planner who developed it in the 1980s.

Here’s how it works:

1. Borrow against the equity in your home: First, you’ll need to take out a home equity line of credit (HELOC) against the equity in your home. This is essentially a loan that’s secured by your home. The amount you can borrow depends on how much equity you have in your home.

2. Invest the borrowed money: Next, you’ll take the money you borrowed from your HELOC and invest it in income-producing assets like stocks, mutual funds, or exchange-traded funds (ETFs). The goal is to earn enough income from your investments to cover the interest on your HELOC.

3. Claim the interest as a tax deduction: Because the interest you pay on your HELOC is used to invest in income-producing assets, you can claim the interest as a tax deduction on your income tax return. This means you’ll pay less tax overall.

4. Use the investment income to pay down your mortgage: Finally, you’ll use the investment income you earn to pay down your mortgage faster. By doing this, you’ll reduce the amount of non-deductible mortgage interest you pay over time.

For detailed information, check out this book dedicated to the subject:

Why should Canadians consider the Smith Maneuver?

There are a few reasons why Canadians might want to consider the Smith Maneuver:

1. Tax savings: By converting non-deductible mortgage interest into tax-deductible investment interest, you can lower your overall tax bill. This can save you thousands of dollars over the long term.

2. Faster mortgage paydown: By using investment income to pay down your mortgage faster, you can potentially save tens of thousands of dollars in interest charges over the life of your mortgage.

3. Building wealth: By investing the borrowed money in income-producing assets, you have the potential to earn a higher return on your money than you would by simply paying down your mortgage. Over the long term, this can help you build wealth and achieve your financial goals faster.

4. Flexibility: The Smith Maneuver is a flexible strategy that can be customized to your individual needs and goals. You can choose how much to borrow against your home equity, which investments to make, and how quickly to pay down your mortgage.

Concluding remarks:

Of course, as with any financial strategy, there are risks and potential downsides to consider. For example, investing always carries some level of risk, and you may not earn a high enough return to cover the interest on your HELOC. Additionally, borrowing against your home equity can be risky if your home value declines, as you could end up owing more than your home is worth.

Overall, the Smith Maneuver is a strategy that can make sense for certain Canadian homeowners who are comfortable with investing and understand the potential risks involved. If you’re interested in learning more, it’s a good idea to speak with a financial advisor who can help you determine whether the Smith Maneuver is right for you.

25 years and still a best seller?! Hint: it’s still making people rich!

Ok, well the book itself is not making people rich, but the knowledge and numerous “aha moments” will! I have listened to thousands of hours of interviews with some of the richest and most successful people in the world — this book is mentioned more than any other, hands down. Why? Well for one, this book change how you see money (or at least it should). We are not taught much financial education in school, and if anything the information we are given is arguably useless. Following the very inspirational and eye-opening chapters of this book, the author does an outstanding job of showing how it is possible for almost anyone to build wealth through investing in assets such as real estate and small businesses, rather than relying solely on traditional forms of income.

Alright, it’s the 21 century and attention spans are short, so without further ado I will reveal this book, followed by some remaining notes and personal takes:

Ok, maybe you’ve heard of this book, maybe not. If you have, great, but do not eye roll — less we not forget that books do not become best sellers for no reasons.

I was first turned onto to this site in my quest for passive income and was impressed by the richerrental.com‘s down to earth and “real” take on this books, as well as their other three top picks.

Alright, now for my closing points:

• This book cannot be unread! When was the last time someone said that about book?

• The storytelling is motivational and the financial opportunity insights made it hard to put the book down.

• This book is basically pandora’s box. Once I finshed reading this book I went on to read dozens more on related topics as well as started my YouTube binge journey, devouring as much financial content as a could.

Today, I am not yet a rich man, but I am well on my way. I don’t think I would be even close to where I am today without the book. Take a read, and check it out. The worst that can happen is saying that you read one of the best selling books in the world and thought it was meh!

Debt Consolidation = Real Estate Investing Opportunity?

Debt consolidation is a financial strategy that involves combining multiple high-interest debts into a single, low-interest loan. This can be a great way to get a handle on your debt and improve your financial situation.

Here are the top 15 benefits of going ahead with debt consolidation:

- Lower interest rates: By consolidating your debt, you can often qualify for a lower interest rate, which can save you money on interest charges over time.

- Lower monthly payments: Consolidating your debt can also lower your monthly payments, making it easier to afford your debt repayment.

- Simplified budgeting: With just one monthly payment to worry about, it’s easier to budget and track your debt repayment progress.

- Fewer creditor calls: When you consolidate your debt, you will only have to deal with one lender, rather than multiple creditors, which can be a relief.

- Improved credit score: As you pay off your debt, your credit score will improve, which can open up more financial opportunities for you in the future.

- Stop collection calls: Consolidating your debt could stop the collection calls and letters you are receiving from your creditors.

- Reduced stress: Dealing with multiple high-interest debts can be stressful, consolidating your debt can help reduce this stress.

- Peace of mind: Knowing that you are taking steps to get control of your debt can give you peace of mind and a sense of accomplishment.

- Tax benefits: Some types of debt consolidation loans, like home equity loans, may offer tax benefits.

- Avoid bankruptcy: Consolidating your debt can help you avoid the negative financial and personal consequences of bankruptcy.

- Flexibility: Many consolidation loans offer flexible repayment options, such as the ability to adjust the loan term, making it easier to fit the payments into your budget.

- Avoid late fees: Late fees and penalties can add up quickly, consolidating your debt can help you avoid these additional charges.

- Avoid wage garnishment: If you are unable to pay your debts, your creditors may seek wage garnishment, consolidating your debt can help you avoid this.

- Access to additional funds: If you consolidate your debt through a home equity loan or line of credit, you may have access to additional funds that you can use for other purposes.

- Debt-free quicker: By consolidating your debt, you can pay off your debts quicker and become debt-free sooner.

At the end of the day, debt consolidation can be a great way to get a handle on your debt and improve your financial situation. From lower interest rates and monthly payments to improved credit scores and reduced stress, the benefits of debt consolidation are numerous. However, it’s important to do your research and choose the right type of consolidation loan for your needs, and make sure you have a plan to avoid falling into debt again. A financial advisor or credit counselor can help you evaluate your options and make the best decision for your financial situation.

Cash Out Refinance To Buy Second Home

The BRRRR Strategy:

“Buy, Renovate, Rent, Refinance, Repeat,” is a real estate investment strategy that allows investors to acquire properties, improve them, and then refinance them at a higher value to pull cash out and repeat the process.

In this blog post, we will discuss two common ways to access the equity in your home: a Home Equity Line of Credit (HELOC) and a Cash-Out Refinance. We will also introduce the BRRRR strategy, a popular real estate investment approach that allows investors to acquire properties, improve them, and then refinance them at a higher value to pull cash out to acquire another property. We will run through some real life BRRRR examples later on in the post!

A HELOC is a revolving line of credit that allows you to borrow against the equity in your home. It works much like a credit card, with a credit limit based on the value of your home and the amount of equity you have. You can borrow as much or as little as you need, and you only pay interest on the amount you borrow. HELOCs typically have variable interest rates, which means your payments may fluctuate over time.

On the other hand, a Cash-Out Refinance involves taking out a new mortgage to replace your existing one. The new mortgage is for a larger amount than your current mortgage, and the difference between the two is paid out to you in cash. This cash can then be used for a variety of purposes, such as home improvements, debt consolidation, or other large expenses. Cash-Out Refinances usually have fixed interest rates, meaning your monthly payments will remain the same over the life of the loan.

Key Differences: HELOC vs. Cash-Out Refinance:

Interest Rates:

- HELOCs generally have variable interest rates.

- Cash-Out Refinances typically have fixed interest rates.

Loan Terms:

- HELOCs have a draw period and a repayment period.

- Cash-Out Refinances have a fixed loan term (usually 15 or 30 years).

Access to Funds:

- With a HELOC, you can borrow and repay funds as needed, up to your credit limit.

- With a Cash-Out Refinance, you receive a lump sum of cash at the time of closing, and you cannot borrow additional funds unless you refinance again.

Closing Costs:

- Both HELOCs and Cash-Out Refinances may have closing costs associated with them.

- The closing costs for a Cash-Out Refinance are typically higher, as they involve the costs of originating a new mortgage.

The BRRRR strategy, which stands for “buy, renovate, rent, refinance, repeat,” is a real estate investment strategy that allows investors to acquire properties, improve them, and then refinance them at a higher value to pull cash out and repeat the process.

The first step of the BRRRR strategy is to find a property that can be purchased below market value. This can be done by searching for foreclosures, short sales, or properties that need significant repairs. Once the property is acquired, the investor will renovate it to increase its value and make it more attractive to renters.

The next step is to re-rent the property at a higher rate than the monthly mortgage payment. This will create positive cash flow, which can be used to pay for the renovations and other expenses.

Once the property has been stabilized and is generating positive cash flow, the investor can refinance the property at a higher value than what was originally paid. This will allow the investor to pull cash out of the property, which can then be used to repeat the process and acquire more properties.

The BRRRR strategy is a great way for investors to grow their real estate portfolio and create long-term wealth. However, it does require a significant amount of capital and knowledge of real estate and renovation to be successful.

Let’s go through a couple hypothetical examples of the BRRRR strategy, using some realistic numbers:

Initial Purchase Price: $300,000

Down Payment (20%): $60,000

Renovation Budget: $20,000

Total Investment: $80,000

Now, let’s assume that the property’s value increases by 20% after renovations. This would bring the new value to $360,000 (based on the appraised value – yes, you need to get the property appraised as part of the process).

New Appraised Value: $360,000

Next, you’ll need to determine the loan-to-value (LTV) ratio for refinancing. A common LTV ratio for investment properties is around 75%. This means that the maximum loan amount would be 75% of the new appraised value, or $270,000.

Maximum Loan Amount: $270,000 (this is the refinanced “cash out” you get)

However you still have to subtract the existing mortgage balance from the maximum loan amount to determine the net cash-out amount. In this case, let’s assume the existing mortgage balance is $240,000 (remember, we put of 20% down ($60k) on the $300k purchase price).

Net Cash-Out Amount: $270,000 – $240,000 = $30,000

Now, subtract the cash-out amount from your total investment to see if you can recover your entire down payment.

Total Investment (down payment + reno costs): $80,000

Cash-Out Amount: $30,000

Remaining UN-recovered initial Investment: $50,000

In this example, you would not be able to recover your initial investment of $80k (down payment + reno), as the cash-out amount is only $30,000. To break even and recover your full down payment, you would need a higher percentage increase in property value after renovations.

For example, if the property’s value increased by 40% after renovations, the new value would be $420,000. Using the same LTV ratio of 75%, the maximum loan amount would be $315,000. Subtracting the existing mortgage balance of $240,000 would result in a cash-out amount of $75,000.

Cash-Out Amount: $315,000 – $240,000 = $75,000

Did we get our full initial investment back this time?!

Total Investment: $80,000

Cash-Out Amount: $75,000

Remaining UN-recovered initial Investment: $5,000

Not too shabby! In this example we recovered our full down payment of $60,000 and most of our renovation costs, meaning we could repeat another BRRRR (e.g. maybe we put in a bit more sweat-equity this time to make up for the $5k less of reno budget). Keep in mind that this example is simplified and doesn’t include closing costs, taxes, and other factors that can impact the actual numbers. But as you can see, the BRRRR strategy is legit – though the “perfect” BRRRR is not all that easy. It requires finding the right undervalued property and a good deal of involvement to improve it such that it can be reappraised for a sufficiently higher value (e.g. as much as 30-40% more than what you bought it for).

In conclusion, both HELOCs and Cash-Out Refinances offer homeowners a way to access the equity in their homes, while the BRRRR strategy provides real estate investors with a powerful method to acquire, renovate, and refinance properties for long-term growth. The best option for you will depend on your individual financial situation, your goals, and your preferences. Be sure to carefully consider the pros and cons of each option before making a decision.

Meet Kevin vs Grant Cardone

Real estate investing is a popular way to build wealth, and there are many resources available to help you learn the ins and outs of the industry. Two of the most well-known names in real estate education are Meet Kevin and Grant Cardone. Both of these companies offer a variety of courses and resources to help you get started in real estate investing, but there are some key differences between the two.

Meet Kevin is a real estate education company founded by Kevin Paffrath, a successful real estate investor and educator. Kevin offers a variety of courses, including the “Real Estate Investing From $0 to Millionaire & Beyond” program, which is designed to teach you the basics of real estate investing and help you build a solid foundation for your business. The course covers topics such as finding deals, financing, and property management. Meet Kevin also offers a mentorship program, which provides one-on-one coaching and support to help you achieve your goals.

Grant Cardone, on the other hand, is a sales and marketing expert who has also made a name for himself in the real estate industry. His company, Cardone Capital, offers a variety of courses to help you build wealth through real estate investing, including “The 10X Rule” and “How to Create Multiple Flows of Income” programs. This course is designed to help you scale your real estate business and achieve financial freedom. The course covers topics such as finding deals, raising capital, and scaling your business. Grant Cardone also offers coaching and mentorship programs, as well as a variety of other resources to help you succeed in real estate investing.

One of the main differences between Meet Kevin and Grant Cardone is their approach to real estate investing. Meet Kevin focuses on building a solid foundation and steady growth, while Grant Cardone focuses on scaling and achieving financial freedom. Meet Kevin’s course is more beginner-friendly and focuses on teaching the basics, while Grant Cardone’s course is geared towards more experienced investors looking to scale their business.

Another key difference is the price point of the courses. Meet Kevin’s course is generally more affordable than Grant Cardone’s.

Ultimately, both Meet Kevin and Grant Cardone offer valuable resources for real estate investors, and the best choice for you will depend on your goals and experience level. If you’re just getting started in real estate investing, Meet Kevin’s course may be a better fit for you. However, if you’re an experienced investor looking to scale your business, Grant Cardone’s course may be more suitable. It’s always best to do your research, read reviews and testimonials, and choose the course that best aligns with your goals.

If after reading this you’re still not interested training / learning through courses, then you can always go through the self taught route. I highly encourage you check out my top recommended real estate / how to earn passive income books on this post: Top 3 Passive Income Books + Bonus pick!

Why You Should Take A Course On Real Estate Investing

Real estate courses pay for themselves in the time and money they will save you!

Not to mention, they will help you think outside the box and find the real estate deal or strategy that is best for you!

Real estate investing can be a great way to build wealth, but it can also be a complex and challenging endeavor. One of the best ways to gain the knowledge and skills needed to succeed in real estate investing is by taking a course on the subject.

Here are 10 reasons why it would be beneficial to take a course on real estate investing instead of trying to learn it on your own:

- Expert instruction: A course on real estate investing will be taught by experts in the field who have a wealth of knowledge and experience to share. They will be able to answer your questions and provide valuable insights that you wouldn’t be able to get on your own.

- Structured learning: A course on real estate investing will provide you with a structured learning experience that will help you absorb the material more effectively. This can be especially beneficial for those who find it difficult to learn on their own.

- Networking opportunities: Taking a course on real estate investing will give you the opportunity to meet and network with other like-minded individuals who are also interested in the field. This can be a great way to make connections and learn from others.

- Hands-on experience: Many real estate investing courses offer hands-on experience through field trips, case studies, and other practical exercises. This can be a great way to see how the concepts you’re learning about are applied in real-world situations.

- Access to resources: A course on real estate investing will provide you with access to a wide range of resources, including books, articles, and websites, that can help you learn more about the subject.

- Certification: Some real estate investing courses offer certification upon completion, which can be a valuable asset when looking for employment or seeking to build credibility with potential clients.

- Avoiding costly mistakes: Real estate investing can be a complex field and it’s easy to make costly mistakes. A course on real estate investing can help you avoid these mistakes and save you money in the long run.

- Keeping you updated with the latest trends and regulations: Real estate market and regulations are constantly changing, a course on real estate investing will keep you updated with the latest trends and regulations in the industry.

- Achieving your goals faster: By taking a course on real estate investing, you can gain the knowledge and skills you need to achieve your goals faster than if you were to try to learn on your own.

- Better return on investment: By gaining the knowledge and skills through a course on real estate investing, you can make better investment decisions, and in turn, achieve a better return on your investment.

At the end of the day, taking a course on real estate investing can be a great way to gain the knowledge and skills needed to succeed in the field. From expert instruction and structured learning to networking opportunities and hands-on experience, there are many benefits to taking a course on real estate investing. Additionally, it can help you avoid costly mistakes, stay updated with the latest trends and regulations, achieve your goals faster, and achieve a better return on investment. It’s worth considering taking a course on real estate investing if you’re serious about building wealth through real estate.

Best (2023) Property Management Software Operation Automation to Business

Property management is a complex and time-consuming task that requires a wide range of skills and knowledge. Fortunately, technology has made it easier for property managers to keep track of their properties and tenants, streamline their operations, and maximize their income. One of the most popular ways to do this is through the use of property management software.

There are many different types of property management software available, each with its own set of features and capabilities. In this article, we will take a look at some of the most popular property management software options on the market today, and discuss the key features and benefits of each.

AppFolio: AppFolio is a cloud-based property management software that provides a comprehensive set of tools for managing rental properties. Some of the key features of AppFolio include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. AppFolio also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants.

Buildium: Buildium is another cloud-based property management software that provides a wide range of tools for managing rental properties. Some of the key features of Buildium include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Buildium also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants.

Propertyware: Propertyware is a cloud-based property management software that provides a comprehensive set of tools for managing rental properties. Some of the key features of Propertyware include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Propertyware also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants.

Yardi: Yardi is a comprehensive property management software that provides a wide range of tools for managing rental properties. Some of the key features of Yardi include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Yardi also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants.

Rent Manager: Rent Manager is a property management software that provides a comprehensive set of tools for managing rental properties. Some of the key features of Rent Manager include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Rent Manager also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, Rent Manager offers a variety of integrations with other software, such as QuickBooks and Yardi, which can help streamline operations and automate tasks.

ResMan: ResMan is a cloud-based property management software that offers a comprehensive set of tools for managing multifamily properties. Some of the key features of ResMan include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. ResMan also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, ResMan offers integrations with other software such as Yardi and QuickBooks, which can help streamline operations and automate tasks.

MRI Software: MRI Software is a comprehensive property management software that offers a wide range of tools for managing commercial and residential properties. Some of the key features of MRI Software include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. MRI Software also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, MRI Software offers integrations with other software such as Yardi and QuickBooks, which can help streamline operations and automate tasks.

Entrata: Entrata is a cloud-based property management software that provides a comprehensive set of tools for managing rental properties. Some of the key features of Entrata include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Entrata also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, Entrata offers integrations with other software such as Yardi and QuickBooks, which can help streamline operations and automate tasks. Entrata also offers a unique feature of having a resident portal that allows tenants to access their account information, pay rent, and submit maintenance requests.

RealPage: RealPage is a comprehensive property management software that offers a wide range of tools for managing commercial and residential properties. Some of the key features of RealPage include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. RealPage also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, RealPage offers integrations with other software such as Yardi and QuickBooks, which can help streamline operations and automate tasks. RealPage also offers a unique feature of having a resident portal that allows tenants to access their account information, pay rent, and submit maintenance requests.

Rentec Direct: Rentec Direct is a cloud-based property management software that offers a comprehensive set of tools for managing rental properties. Some of the key features of Rentec Direct include property and tenant management, accounting and financial reporting, online rent collection, and marketing and lead management. Rentec Direct also offers a mobile app that allows property managers to access their data from anywhere and stay on top of their properties and tenants. Additionally, Rentec Direct offers integrations with other software such as QuickBooks and Yardi, which can help streamline operations and automate tasks. Rentec Direct also offers a unique feature of having a resident portal that allows tenants to access their account information, pay rent, and submit maintenance requests.

In conclusion, there are many different types of property management software available, each with its own set of features and capabilities. The software mentioned above are some of the most popular options on the market today, and provide a comprehensive set of tools for managing rental properties. From property and tenant management to accounting and financial reporting, online rent collection, and marketing and lead management, these software can help property managers streamline operations, save time and money, and improve the overall performance of their properties. It’s important to research and choose the software that best for your needs!